Tel Aviv Stock Exchange remains resilient despite ongoing multi-front war

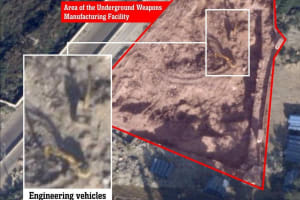

The past year has been significantly challenging for the Israeli economy due to the nation's ongoing multi-front war against Iranian-led terror proxy groups in the region. Despite several downgrades issued by popular credit agencies, along with a growing deficit and persistent inflation, the Tel Aviv Stock Exchange has been resilient and continues to attract funding from investors.

The Tel Aviv Stock Exchange 35 Index, its flagship index, increased by 14% since Oct. 7, 2023, when Hamas terrorists invaded southern Israeli border communities, which led to the current war with Israel. Since then, the conflict has expanded significantly, as Israel faces attacks from Hezbollah forces in the north, Houthi rebels from Yemen and two direct attacks from the Islamic Republic of Iran.

In early October, S&P Global downgraded Israel’s credit rating from A+ to A, citing increased security threats due to the war with Hezbollah.

“We see an increasing likelihood that Israel’s conflict with Hezbollah, given the recent escalation of fighting, becomes more protracted and intensifies, posing security risks for Israel," the credit agency stated.

Despite these challenges, the Tel Aviv Banks Index noted a 9.3% increase since the Oct. 7 terror attack. During the same period, the Tel Aviv Real Estate index rose by 14.2%. In addition, the Israeli shekel retained most of its value against the dollar, signaling a resilient Israeli economy.

Elbit Systems, an international high technology company primarily in defense and homeland security, as well as other leading Israeli companies, have played a central role in Israel’s successful counter-offensive against the Iranian regime and its regional proxies. Cutting-edge Israeli military technologies have been showcased throughout the war, leading to the strengthening of war stocks. In the second quarter of 2024, Elbit noted a 12% increase in revenues and a backlog of orders estimated to a record $21 billion.

Elbit Systems President Bezhalel Machlis explained that global anti-Israel calls for boycotts of Israeli products and services had temporarily weakened the value of the company’s stocks.

"It affects us not only in England. The Bank of Nova Scotia in Canada, which was a large investor in Elbit, sold a substantial stake in Elbit and pushed the share price down," Machlis said. However, much of the company’s revenue is linked to the Israeli military, which has dramatically increased its spending over the past year.

The Israeli tech industry is the main engine of the Israeli economy. In February, about 60% of multinational companies expressed continued confidence in the Israeli tech industry, according to an Ernst & Young poll.

A Startup Nation Central report revealed earlier this year that the Israeli tech industry raised $3.1 billion in funding since the Oct. 7, 2023 attack by the Hamas terror group.

In June, Bank of Israel Governor Amir Yaron estimated that the ongoing war would cost the Israeli economy some $67 billion in civilian and military expenses for the period 2023 to 2025. However, many pundits believe that the Israeli economy will rebound once the war is over.

The All Israel News Staff is a team of journalists in Israel.